Insights

A closer look at our people, projects, and progress.

2025-11-27

How Important Is It for a Real Estate Project to Be Located in th...

Discover why a prime city location matters in real estate. Mumbai homes offer connectivity...

Read More

2025-11-27

How Redevelopment is Positive for a New Homebuyer in Mumbai

Redevelopment in Mumbai offers new homebuyers prime locations, modern amenities, safety, a...

Read More

2025-10-31

Work-Life Balance: Why Proximity to Business Hubs Makes All the D...

Proximity to business hubs can transform your daily routine by cutting travel time, reduci...

Read More

2025-10-31

First-Time Homebuyer’s Guide to Choosing the Right Flat in Mumbai

A first-time buyer’s practical guide to navigating Mumbai’s complex real estate market. Le...

Read More

2025-10-01

Why Properties in Andheri East Offer Great Value for Buyers

Andheri East has become one of Mumbai’s most desirable real estate destinations, offering ...

Read More

2025-08-29

Why Mumbai’s Business Hubs are Moving Towards Integrated Commerci...

Explore how Mumbai’s business districts—from Nariman Point to BKC and Andheri—are evolving...

Read More

2025-08-29

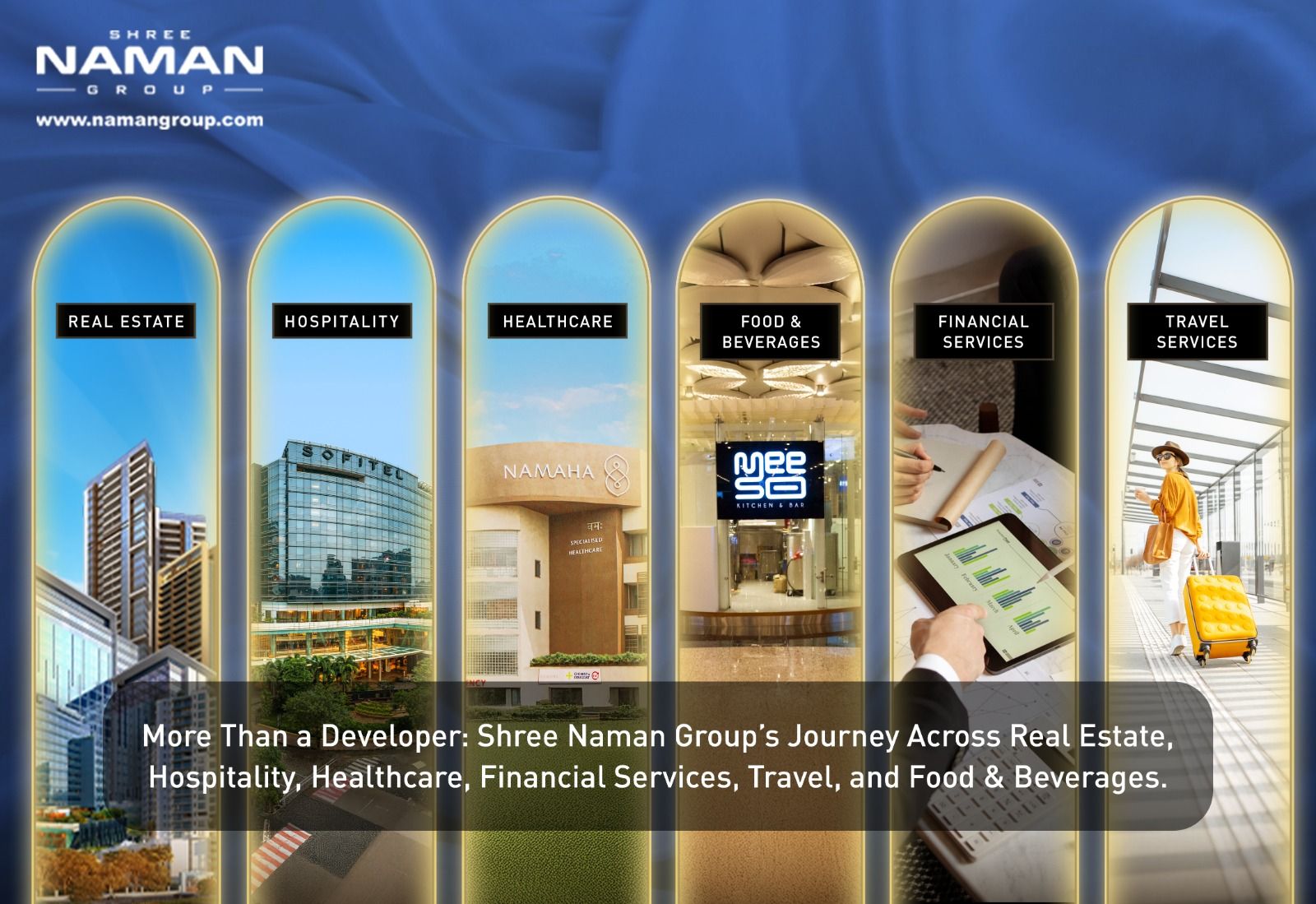

More Than a Developer: Shree Naman Group’s Journey Across Real Es...

Shree Naman Group, founded in 1993, has grown from a real estate developer into a diversif...

Read More

2025-07-21

Why Mumbai Continues to Attract Luxury Homebuyers from Across Ind...

Explore Naman Xana by Shree Naman Group — a breathtaking sea‑facing tower in Worli offerin...

Read More

2025-06-21

Why Businesses Prefer Naman Midtown: A Commercial Hub Like No Oth...

Discover why Naman Midtown in Lower Parel is Mumbai’s premier commercial destination—strat...

Read More