Insights

A closer look at our people, projects, and progress.

2026-02-26

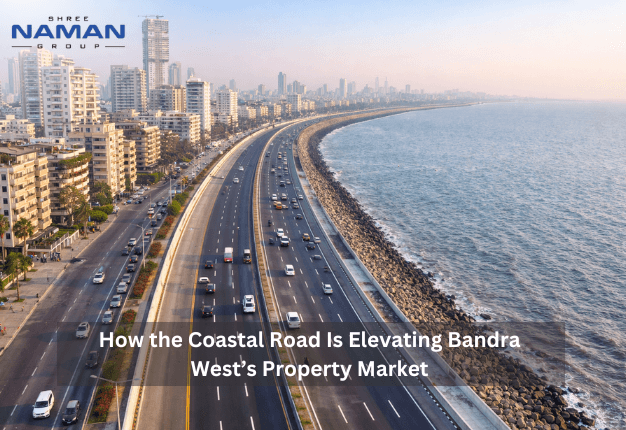

How the Coastal Road Is Elevating Bandra West’s Property Market

Learn how the Coastal Road project is enhancing connectivity and elevating the demand and ...

Read More

2026-02-26

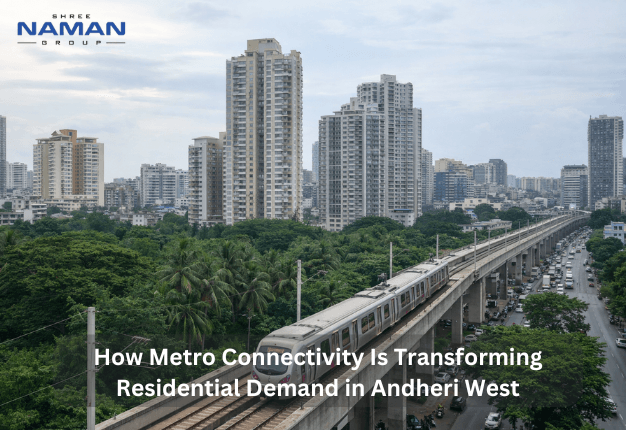

How Metro Connectivity Is Transforming Residential Demand in Andh...

Discover how metro connectivity in Andheri West is reshaping residential demand and elevat...

Read More

2026-01-31

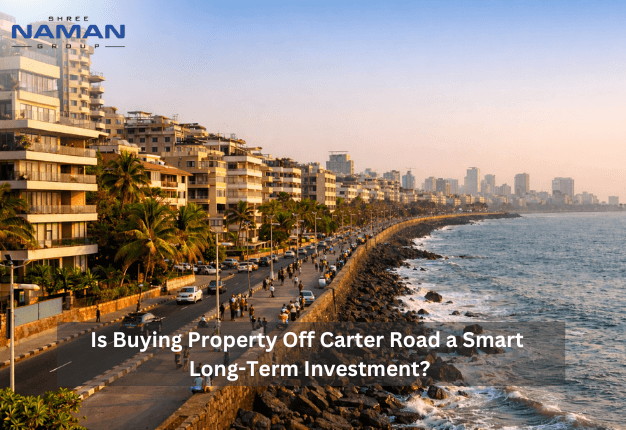

Is Buying Property Off Carter Road a Smart Long-Term Investment?

This blog evaluates the investment prospects of buying property off Carter Road, covering ...

Read More

2026-01-31

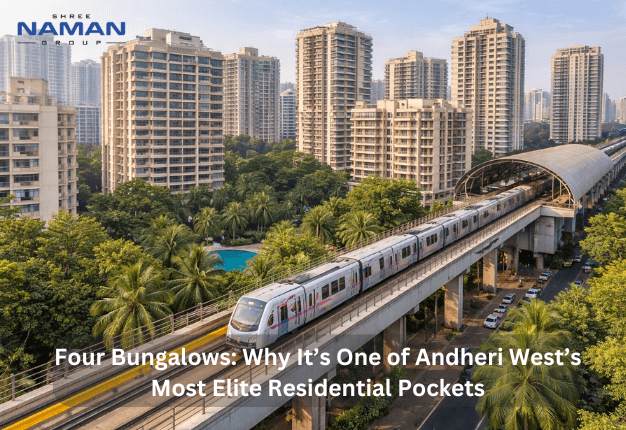

Four Bungalows: Why It’s One of Andheri West’s Most Elite Residen...

This blog explores what makes Four Bungalows a preferred address for discerning homebuyers...

Read More

2025-12-24

How to Check the Credibility of a Real Estate Developer

This blog explains key ways to assess a real estate developer’s credibility — from examini...

Read More

2025-12-24

Why Naman Habitat Appeals to Today’s Working Professionals & Youn...

Naman Habitat in Andheri West offers thoughtfully designed homes with excellent connectivi...

Read More

2025-11-27

How Redevelopment is Positive for a New Homebuyer in Mumbai

Redevelopment in Mumbai offers new homebuyers prime locations, modern amenities, safety, a...

Read More

2025-11-27

How Important Is It for a Real Estate Project to Be Located in th...

Discover why a prime city location matters in real estate. Mumbai homes offer connectivity...

Read More

2025-10-31

First-Time Homebuyer’s Guide to Choosing the Right Flat in Mumbai

A first-time buyer’s practical guide to navigating Mumbai’s complex real estate market. Le...

Read More